If you’re someone who frequently travels to Thailand and spend a significant time in the country, it’s a good idea to look into opening up your own bank account.

Typically those holding a working, retirement, or student visa can open an account with any Thai bank without much hassle, but what if you’re only in the country on a 30-60 days tourist visa? The answer is: Yes, you can too! (conditions apply)

Bank account benefits

Carrying less cash in your pockets

Although in Thailand it’s relatively safe to be walking around with a wad of cash in your pocket, it doesn’t mean the risk of being pick pocketed or theft from hotel staff is zero. Having a bank account where you can safely deposit your cash will give you peace of mind.

Withdrawal fees is zero (with a catch)

There are no fees to withdraw money from an ATM within the province you opened your bank account in, so it’s important you pick the right branch. Let’s say you often reside in Bangkok and decide to open an account there.

Then on the weekend, you travel to Phuket and decide to withdraw some money there. In Phuket you will see that there is a withdrawal fee, whereas in Bangkok there are none.

Bank branches in Thailand are province linked, unlike in the western world where it’s linked nationwide.

E-payment

Everywhere you go you’ll see merchants with QR codes that you can scan with your phone and quickly pay for things.

Also in reverse of that, if you want to receive payment, bring up your own QR code on your phone so someone can scan and transfer you funds instantly.

E-payment is widely accepted and commonly used in Thailand for it’s convenience.

What to know before you open an account

Tourist on 30 days visa exempt/visa on arrival are allowed to open an account with Bangkok Bank with the right documentation. Other banks such as SCB, kBank, UOB, etc. have restrictions on foreigners without a work or study permit.

Another thing you should know is policies differ from branch to branch. If one branch says you can’t open an account, try another branch. Their answer is likely going to be different.

From my experience, I walked into a Bangkok Bank branch in a Big C by Saphan Kwai BTS station and was told they do not open accounts for foreigners. I went into downtown (a tourist hotspot) instead and asked the branch in Emquartier, they said yes!

Documentation required

- Passport – Valid passport with expiration no less than 6 months.

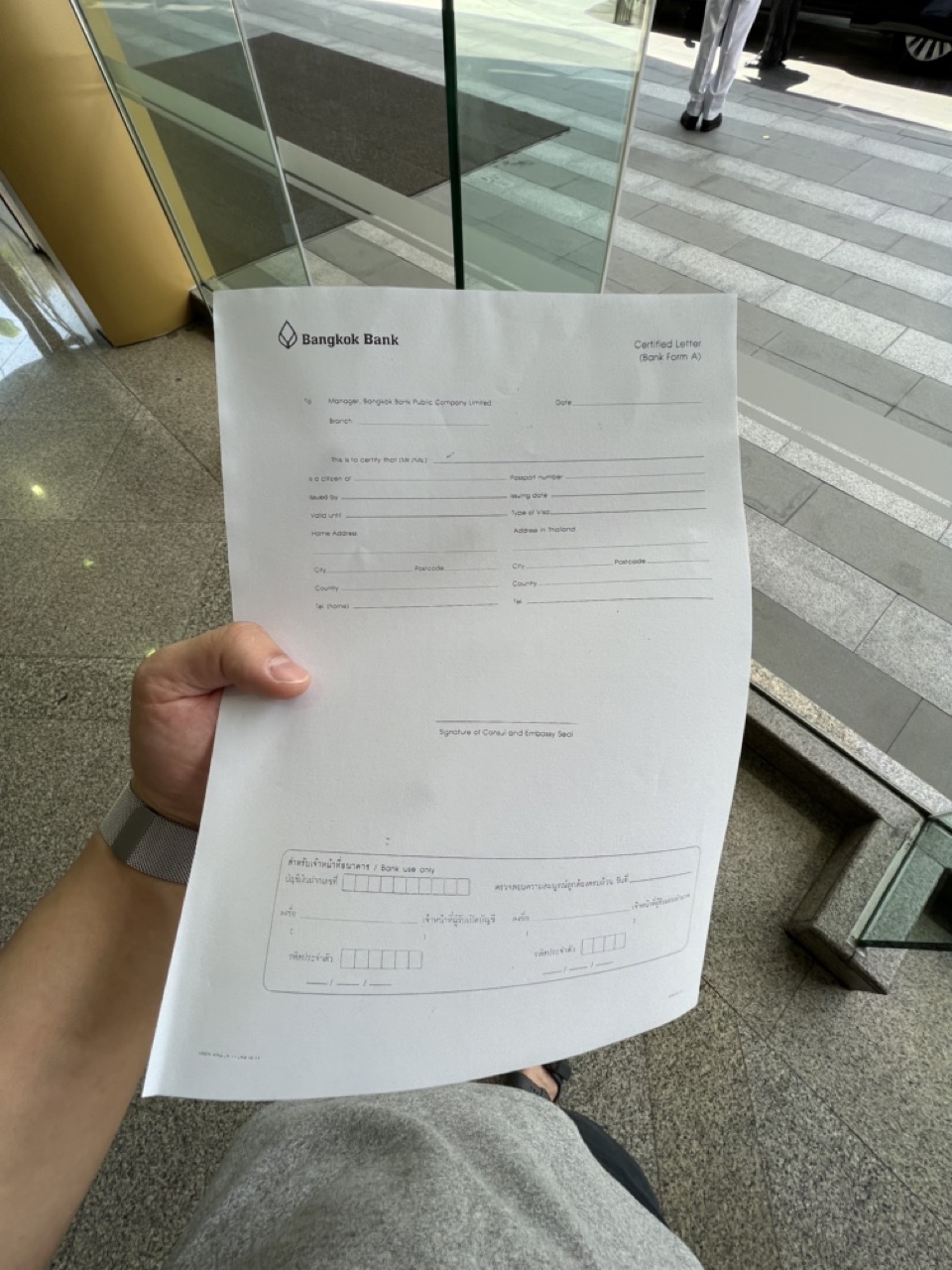

- Certification letter – Before you go to your embassy in Thailand, walk into a Bangkok Bank branch and ask for their Certification Letter – Form A. Take some time to fill this out neatly before you bring it to your embassy. They will use this form to certify your passport.

- Address in Thailand – For those like me who are in Thailand on a Visa Exempt 30-days tourist entry (I’m from Canada), ask a local friend if you can use their address on your application. The address you list can not be a hotel/hostel. The only verification they needed was verbal when they asked “what is this address?” and I responded with, “a friend’s address.” That was it.

- Book an appointment with your embassy – Notary services from your embassy may require you to book an appointment ahead of time, as in my case with the Canadian Embassy.

- Prepare to pay your fees – With your embassy, they will likely charge your credit card in your home currency, not Thai Bahts. For me it was $50 for the passport certification service.

The other fees you will be paying is at the Bank of 300 bahts to open your account. (200 for annual fee + 100 for the debit card)

There is also a minimum initial deposit for 500 bahts when you enroll. You can withdraw this amount immediately if you wish. - They will try to sell you insurance – As you’re opening your account, there will be someone who will try to persuade you to enrol in a more premium debit card that has special features such as access to BTS Rabbit card, worldwide payment on the Mastercard network, and life insurance coverage worldwide. The annual fee is a lot higher than your basic debit card.

If those benefits are something you think you’ll be using, then go right on and sign up.

But if it’s something you don’t want to be pressured into, then politely deny that form of debit card and ask for the basic debit card where you can just withdraw your money.

Here’s how the basic debit card looks like and you can use this to show them:

They may try a sales tactic in trying to trick you into thinking that this special card is their only debit card (happened to me, but I saw the sales pitch a mile away,) politely refuse and insist you want the basic debit card to use for withdrawal and deposit.

If they are demanding you sign up for the premium debit card before you can open an account, refuse, collect back all your documents, and go to another branch.

Be selective of the branch in the beginning. This will be the better option in long-term bank to client relationship and travel time, because wherever you open your account is where you will need to go to make any future big changes to your account.

Foreign funds transfers

Transferring funds from your home bank account to your Thai bank account is seamless!

The app I use to do this is Wise and it’s been the easiest way. The low fees are transparent and you know exactly how much it cost.

Connect your bank account to the app, and within minutes you’ll get your funds in your Thai bank account.

Sign up here using my code and you’ll get a bonus when you make a transfer.

If you like my work, you can buy me a coffee! Your support will help me keep going!

Please share this post if you think it’s awesome!